Are Furniture And Fixtures A Debit Or Credit . Furniture and fixtures are items that are used to furnish an office or business premises and are movable. Generally, assets and expenses have a positive balance so they are placed on the debit. It refers to tangible assets not considered part of a building’s structure. Examples include desks, chairs, filing. Furniture, fixtures, and equipment (ff&e) is a term in the accounting and hospitality industries. Items that appear on the debit side of the trial balance. Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: To record the purchase of a fixed asset, debit the asset account for the purchase price, and credit the cash account for the same. Learn about furniture, fixtures, and equipment (ff&e) in accounting terms. Furniture and fixtures wear out. Discover the significance of ff&e, its depreciation, and. Assets classified as furniture and fixtures are usually aggregated into a single fixed assets line item, which appears in the long.

from www.chegg.com

Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: Assets classified as furniture and fixtures are usually aggregated into a single fixed assets line item, which appears in the long. Items that appear on the debit side of the trial balance. To record the purchase of a fixed asset, debit the asset account for the purchase price, and credit the cash account for the same. Examples include desks, chairs, filing. Furniture and fixtures are items that are used to furnish an office or business premises and are movable. Learn about furniture, fixtures, and equipment (ff&e) in accounting terms. Furniture, fixtures, and equipment (ff&e) is a term in the accounting and hospitality industries. Furniture and fixtures wear out. It refers to tangible assets not considered part of a building’s structure.

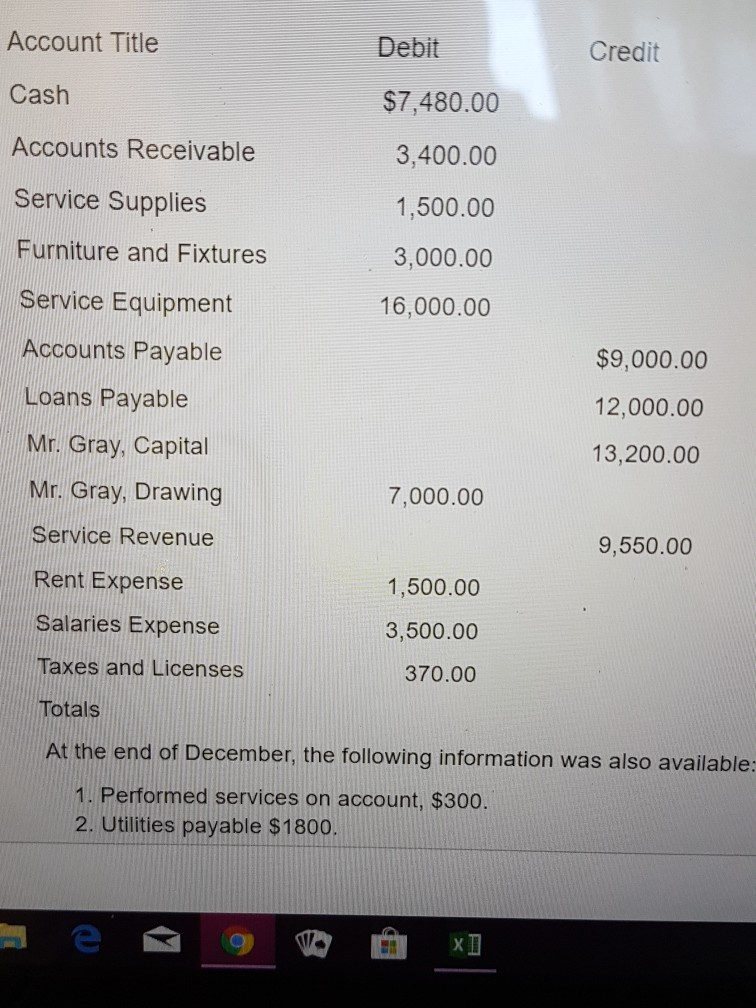

Solved Account Title Debit Credit Cash Accounts Receivable

Are Furniture And Fixtures A Debit Or Credit Assets classified as furniture and fixtures are usually aggregated into a single fixed assets line item, which appears in the long. To record the purchase of a fixed asset, debit the asset account for the purchase price, and credit the cash account for the same. Examples include desks, chairs, filing. Furniture and fixtures are items that are used to furnish an office or business premises and are movable. Assets classified as furniture and fixtures are usually aggregated into a single fixed assets line item, which appears in the long. Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: Learn about furniture, fixtures, and equipment (ff&e) in accounting terms. Furniture, fixtures, and equipment (ff&e) is a term in the accounting and hospitality industries. Generally, assets and expenses have a positive balance so they are placed on the debit. Furniture and fixtures wear out. Discover the significance of ff&e, its depreciation, and. It refers to tangible assets not considered part of a building’s structure. Items that appear on the debit side of the trial balance.

From www.chegg.com

Solved Account Title Debit Credit Cash Accounts Receivable Are Furniture And Fixtures A Debit Or Credit Assets classified as furniture and fixtures are usually aggregated into a single fixed assets line item, which appears in the long. It refers to tangible assets not considered part of a building’s structure. Discover the significance of ff&e, its depreciation, and. Furniture and fixtures wear out. Furniture, fixtures, and equipment (ff&e) is a term in the accounting and hospitality industries.. Are Furniture And Fixtures A Debit Or Credit.

From www.chegg.com

Solved Account Title Debit Credit Cash Accounts Receivable Are Furniture And Fixtures A Debit Or Credit Discover the significance of ff&e, its depreciation, and. Examples include desks, chairs, filing. Items that appear on the debit side of the trial balance. Furniture, fixtures, and equipment (ff&e) is a term in the accounting and hospitality industries. Learn about furniture, fixtures, and equipment (ff&e) in accounting terms. Furniture and fixtures wear out. It refers to tangible assets not considered. Are Furniture And Fixtures A Debit Or Credit.

From www.studocu.com

46511679 Balance Sheet Valix C1Valix PRACTICAL ACCOUNTING 1 BALANCE Are Furniture And Fixtures A Debit Or Credit Furniture, fixtures, and equipment (ff&e) is a term in the accounting and hospitality industries. Items that appear on the debit side of the trial balance. Learn about furniture, fixtures, and equipment (ff&e) in accounting terms. Generally, assets and expenses have a positive balance so they are placed on the debit. Discover the significance of ff&e, its depreciation, and. Understanding “furniture. Are Furniture And Fixtures A Debit Or Credit.

From www.chegg.com

Solved Mystic Masters, Inc., provides Are Furniture And Fixtures A Debit Or Credit Assets classified as furniture and fixtures are usually aggregated into a single fixed assets line item, which appears in the long. Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: Furniture and fixtures are items that are used to furnish an office or business premises and are movable. Discover the significance of ff&e, its depreciation, and. Examples include. Are Furniture And Fixtures A Debit Or Credit.

From www.chegg.com

Solved Mystic Masters, Inc., provides Are Furniture And Fixtures A Debit Or Credit Learn about furniture, fixtures, and equipment (ff&e) in accounting terms. Examples include desks, chairs, filing. Items that appear on the debit side of the trial balance. Furniture and fixtures are items that are used to furnish an office or business premises and are movable. It refers to tangible assets not considered part of a building’s structure. Furniture and fixtures wear. Are Furniture And Fixtures A Debit Or Credit.

From www.coursehero.com

[Solved] . Cash Furniture and Fixtures De Jesus, Capital Debit Credit Are Furniture And Fixtures A Debit Or Credit Examples include desks, chairs, filing. To record the purchase of a fixed asset, debit the asset account for the purchase price, and credit the cash account for the same. Items that appear on the debit side of the trial balance. Furniture and fixtures wear out. Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: Assets classified as furniture. Are Furniture And Fixtures A Debit Or Credit.

From dl-uk.apowersoft.com

Printable Debits And Credits Cheat Sheet Are Furniture And Fixtures A Debit Or Credit Examples include desks, chairs, filing. Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: Furniture, fixtures, and equipment (ff&e) is a term in the accounting and hospitality industries. Items that appear on the debit side of the trial balance. Learn about furniture, fixtures, and equipment (ff&e) in accounting terms. Generally, assets and expenses have a positive balance so. Are Furniture And Fixtures A Debit Or Credit.

From www.solutioninn.com

[Solved] The trial balance for Sharmar for the per SolutionInn Are Furniture And Fixtures A Debit Or Credit Learn about furniture, fixtures, and equipment (ff&e) in accounting terms. Furniture and fixtures are items that are used to furnish an office or business premises and are movable. Furniture and fixtures wear out. Generally, assets and expenses have a positive balance so they are placed on the debit. Discover the significance of ff&e, its depreciation, and. To record the purchase. Are Furniture And Fixtures A Debit Or Credit.

From www.solutioninn.com

[Solved] Mystic Masters, Inc., provides services over Are Furniture And Fixtures A Debit Or Credit It refers to tangible assets not considered part of a building’s structure. Furniture, fixtures, and equipment (ff&e) is a term in the accounting and hospitality industries. Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: Examples include desks, chairs, filing. To record the purchase of a fixed asset, debit the asset account for the purchase price, and credit. Are Furniture And Fixtures A Debit Or Credit.

From www.chegg.com

Solved The following is the adjusted trial balance of Best Are Furniture And Fixtures A Debit Or Credit Learn about furniture, fixtures, and equipment (ff&e) in accounting terms. Items that appear on the debit side of the trial balance. Furniture and fixtures wear out. Furniture and fixtures are items that are used to furnish an office or business premises and are movable. Examples include desks, chairs, filing. Generally, assets and expenses have a positive balance so they are. Are Furniture And Fixtures A Debit Or Credit.

From mavink.com

Account Titles And Explanation Are Furniture And Fixtures A Debit Or Credit Examples include desks, chairs, filing. Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: It refers to tangible assets not considered part of a building’s structure. Assets classified as furniture and fixtures are usually aggregated into a single fixed assets line item, which appears in the long. To record the purchase of a fixed asset, debit the asset. Are Furniture And Fixtures A Debit Or Credit.

From biz.libretexts.org

3.6 Prepare a Trial Balance Business LibreTexts Are Furniture And Fixtures A Debit Or Credit Furniture and fixtures are items that are used to furnish an office or business premises and are movable. Examples include desks, chairs, filing. Learn about furniture, fixtures, and equipment (ff&e) in accounting terms. Furniture and fixtures wear out. Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: Assets classified as furniture and fixtures are usually aggregated into a. Are Furniture And Fixtures A Debit Or Credit.

From www.chegg.com

Solved Mystic Masters, Inc., provides Are Furniture And Fixtures A Debit Or Credit Furniture and fixtures are items that are used to furnish an office or business premises and are movable. Furniture, fixtures, and equipment (ff&e) is a term in the accounting and hospitality industries. Items that appear on the debit side of the trial balance. Furniture and fixtures wear out. Discover the significance of ff&e, its depreciation, and. Understanding “furniture and fixtures. Are Furniture And Fixtures A Debit Or Credit.

From www.chegg.com

Solved Mystic Masters, Inc., provides Are Furniture And Fixtures A Debit Or Credit Examples include desks, chairs, filing. Furniture and fixtures are items that are used to furnish an office or business premises and are movable. Items that appear on the debit side of the trial balance. Furniture and fixtures wear out. Understanding “furniture and fixtures in accounting,” or ff&e, is essential because: Learn about furniture, fixtures, and equipment (ff&e) in accounting terms.. Are Furniture And Fixtures A Debit Or Credit.

From www.chegg.com

Solved Requirement 1. Journalize the transactions. (Record Are Furniture And Fixtures A Debit Or Credit It refers to tangible assets not considered part of a building’s structure. Furniture, fixtures, and equipment (ff&e) is a term in the accounting and hospitality industries. Learn about furniture, fixtures, and equipment (ff&e) in accounting terms. Items that appear on the debit side of the trial balance. To record the purchase of a fixed asset, debit the asset account for. Are Furniture And Fixtures A Debit Or Credit.

From prntbl.concejomunicipaldechinu.gov.co

Printable Debits And Credits Cheat Sheet prntbl Are Furniture And Fixtures A Debit Or Credit To record the purchase of a fixed asset, debit the asset account for the purchase price, and credit the cash account for the same. Learn about furniture, fixtures, and equipment (ff&e) in accounting terms. It refers to tangible assets not considered part of a building’s structure. Furniture and fixtures wear out. Items that appear on the debit side of the. Are Furniture And Fixtures A Debit Or Credit.

From hadoma.com

Double Entry Accounting (2022) Are Furniture And Fixtures A Debit Or Credit Examples include desks, chairs, filing. Furniture and fixtures wear out. Generally, assets and expenses have a positive balance so they are placed on the debit. Assets classified as furniture and fixtures are usually aggregated into a single fixed assets line item, which appears in the long. To record the purchase of a fixed asset, debit the asset account for the. Are Furniture And Fixtures A Debit Or Credit.

From www.patriotsoftware.com

Accounting Basics Debits and Credits Are Furniture And Fixtures A Debit Or Credit It refers to tangible assets not considered part of a building’s structure. Furniture and fixtures are items that are used to furnish an office or business premises and are movable. Furniture and fixtures wear out. Furniture, fixtures, and equipment (ff&e) is a term in the accounting and hospitality industries. Examples include desks, chairs, filing. Understanding “furniture and fixtures in accounting,”. Are Furniture And Fixtures A Debit Or Credit.